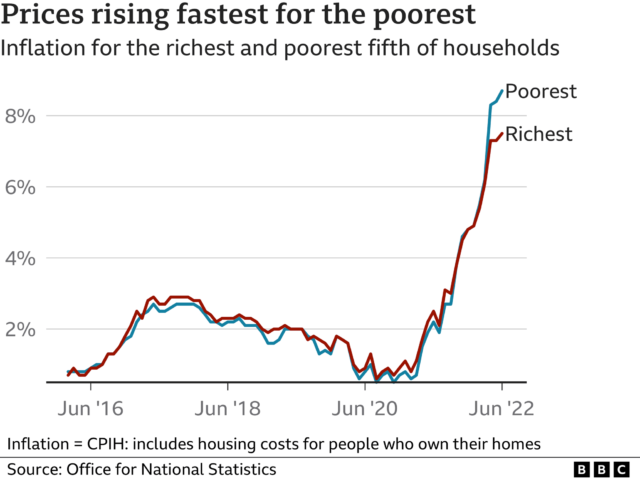

UK inflation has risen to 10.1% in July, the first time it’s hit double digits in 40 years, according to the ONS – up from 9.4% in June. Driven by rising costs in energy, food and fuel, this has resulted in a drastic drop in funding and valuations across the startup arena, with a damning report from Tech Nation revealing that 50% of earlier-stage startups were struggling to scale beyond the seed and pre-seed stages. Whilst almost a quarter of British tech companies made it to series C or exit stage in 2021, it is evident that more could be done to nurture startups at the early stage. After what has been a surprising turn of events for the startup sector, Nayan Gala, growth strategist and founder of global startup investment banking platform, JPIN, explains that businesses should now lean on other economies for some of the most crucial ingredients needed to scale – primarily funding, operation and talent.

Currently, businesses are struggling with low growth, investment and a skills shortage, meaning that employers are having to pay more to retain talent and for general costs of operations. This comes after Britain’s record year for tech investment and IPOs in 2021, and now, new data from Startups Magazine shows that 1-in-5 of UK startups fail in the first year – this increases to 60% within the first three years. Further to this, a new study from iwoca found that SMEs are borrowing more to improve their cash flow, after a record decline in capital from investors, and financial support from the government. The report found that the demand for loans over £200,000 rose by eight percentage points between the first two quarters of 2022.

In what Gala describes as a pivotal moment for startups across the country, he explains that early-stage businesses should use this time to build resilience and improve their business models to increase their chance of success in the future. This includes being more prepared in managing finances and sourcing investment from different routes. Whilst business bank loans are primarily the main vehicles of wealth used by British firms, soaring inflation and rising interest rates mean that this could no longer be the best route due to the current economic turbulence. Sourcing international investment from countries that are suffering less amidst the downturn is becoming an increasingly attractive option, but firms need to have the right expertise on board to access capital from different territories.

Britain’s skills shortage has also been a driving factor in the stunted growth of UK firms. Employers are currently spending more just to retain staff, as the Great Resignation continues to fuel workers’ motives across the country. Research from the CIPD and the University of Birmingham has revealed that one-in-five (20%) of workers say it’s likely they will quit their current role in the next 12 months, whilst the ONS found that the number of job vacancies in April to June this year rose to almost 1.3 million. That being said, Gala explains that there is still a global surplus of skilled workers that employers should consider that can even work remotely. He states that the world’s emerging markets still hold an illustrious array of talent, not just in skill but also in leadership and the ability to navigate complex situations – particularly when it comes to scaling organisations.

Nayan Gala, growth strategist and founder of JPIN, comments:

“Startups and early-stage businesses should not panic amidst the current landscape – there are investors that are still looking to invest in firms to expand their portfolios. The main difference is that they are narrowing down their choices and being more vigilant with their capital.

“Firms must now use their time to build resilience and solidify their business strategy in preparation for the future. From my experience working across the startup sector in various countries, there are usually alternative options to source investment and talent. It may now be time for British firms to look outside their comfort zone and lean on other economies for opportunities to boost capital and expand their workforce.

“Startups are ultimately crucial to the economy, as countries need tech innovation to stimulate growth. SMEs across the UK would benefit hugely from the government spending a higher percentage of its procurement budget on helping these firms. However, in the absence of this, there is still a wealth of options out there that can help fill this gap including international funding and talent that could potentially act as a lifeline to many UK businesses – particularly early-stage firms.”