Online research from Equifax[1], the credit information provider, reveals over a third (38%) of people living in the East of England believe the UK will be a cashless society within the next 10 years. This compares to the North East of England, which appears the most sceptical with only 27% thinking the same. New figures show that debit card payments have overtaken cash use for the first time, a total of 13.2 billion debit card payments were made last year, a rise of 14% on the previous year. This is not surprising due to the innovative and modern new businesses that, of course, are using card payments. Paying by card is being integrated into almost all parts of society, with even laundromats using laundry payment systems that involve contactless pay instead of using cash.[2]

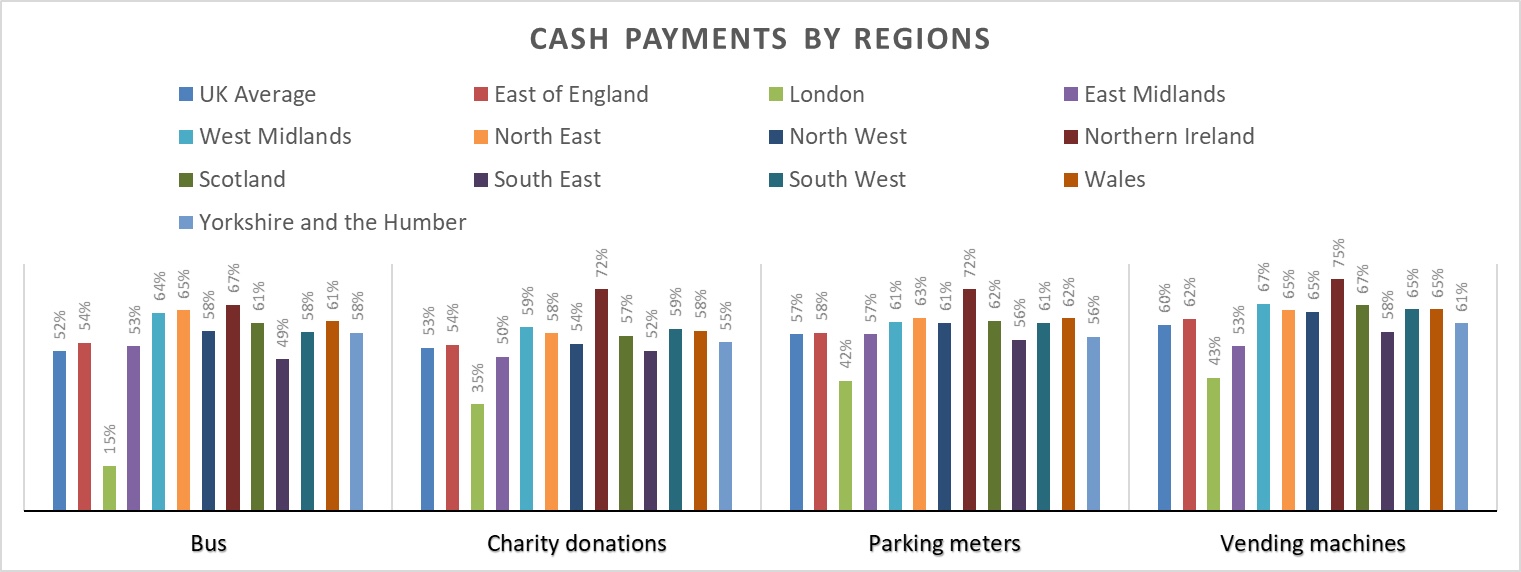

However, the research shows that while the use of cash is declining, it still has its fans. In the survey, conducted with Gorkana, respondents in the East of England said coins are their top payment choice for vending machines (62%), parking meters (57%), charity donations (54%), and buses (54%).

Whilst there clearly is a preference to use cash for some things, there has been a shift towards using less cash over the last couple of years. Over half (51%) of those living in the East of England use cash less than they did three years ago, this compares to the UK average of 46%. And 40% in the East of England think shops, cafes or market stalls that only accept cash are inconvenient, highlighting the shift from cash to digital payments.

This transition to digital payments may also herald the eventual implementation of cryptocurrencies in everyday life. You can get ahead of this and start trading in them today and grow your crypto wallet because, the way things are going, they are set to become the norm before long. You may also want to take a look at mining hotspots (like this – Bobcat Helium Miner ship now) as you can set this device to work for you in order to gain a new source of passive income to bolster your finances.

The findings also highlight that although the use of digital payments via contactless cards and online transactions is growing rapidly[3], some people are still wary about security. Over a quarter of respondents in the East of England don’t feel confident that payments via websites or contactless cards are secure, and 26% think it’s difficult to track money spent using digital methods.