Yesterday the British Pound plunged to $1.03, its lowest since 1971 after the UK mini-budget rocked markets. But why has this happened and what does it mean for UK markets?

Dan Ashmore, analyst at Invezz, commented:

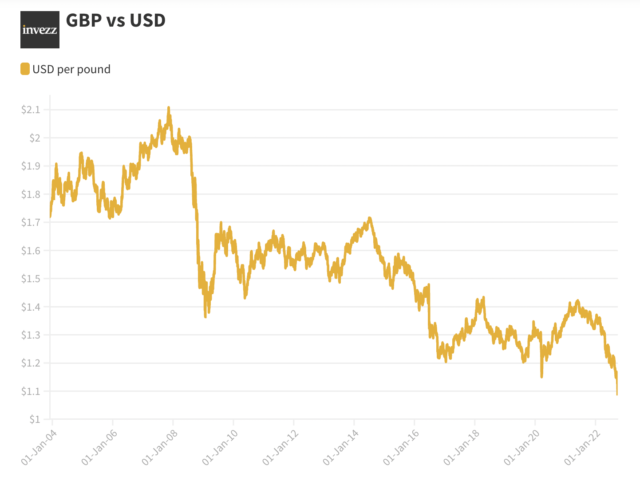

“The UK mini-budget proposing tax cuts last week has provided investors with extra reasons to sell GBP. While the exchange rate has rebounded slightly as I write this to $1.07, it’s still a massive drop and it’s not beyond the realm of the possibility that we could soon get pound-dollar parity. The chart below paints a grim picture of how stark the sell-off is in historical terms.

The latest plunge comes in response to new Prime Minister Lizz Truss’ administration announcing a new UK mini-budget. A host of tax cuts and spending measures have caused concern among investors at the sustainability of the UK economy.

The UK current account deficit was already at record levels before this latest plunge in the pound. While the energy crisis had already been putting the balance of payments under pressure. This latest blow will do nothing to quell the sell-off in the pound.

The dollar repeatedly strengthens during turbulent economic periods. When uncertainty floods markets, investors move to safe-haven assets, and there is no safer currency in the eyes of investors than the US dollar. I plotted the DXY index historically, and the upwards moves in times of recessions are clear.

The Bank of England has said they will ‘not hesitate’ to raise interest rates after the pound fell and expectations are they will be hiked more aggressively than previously expected. If this scenario transpires, this would suck liquidity out of the market, further raise discount rates used to value the future cash flows of companies and ultimately negatively impact the stock market.

But no matter what way you swing it, we live in a dollarized world. As the music stops on the historic 10-year financial market bull run, I’ve been warning all year that the only currency you want to hold is dollar. I’m not changing my position now, even as pound/dollar parity nears.”